The CRA has just published the new TD1 form which reflects the changes to the basic personal amount announced on December 9 and which took effect on January 1, 2020.

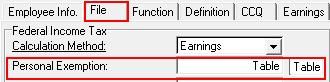

For employees who do not request the basic personal amount only on the TD1 form (line 1), you will have to provide them with the new TD1 form, then enter the amount of exemptions in their file, on the Personal Exemption line (Employee file > File > Federal Income Tax).

However, for employees who request the basic personal amount only on the TD1 form (line 1), the Personal Exemption line must correspond to Table. Therefore, the calculation of payrolls will take into account the form provided by the CRA, which was already included in version 12.0 of Acomba. In this case, the employee's basic personal amount is calculated according to the employee's income on each pay.