Employers can apply for the temporary wage subsidy immediately or wait until after June 20, when the period covered by the subsidy will be finished.

To learn more about this grant, consult the news item Flexibility Measures for individuals and businesses > section March 23 – Federal.

To help you calculate the subsidy in your software :

Calculation of the wage subsidy for employers

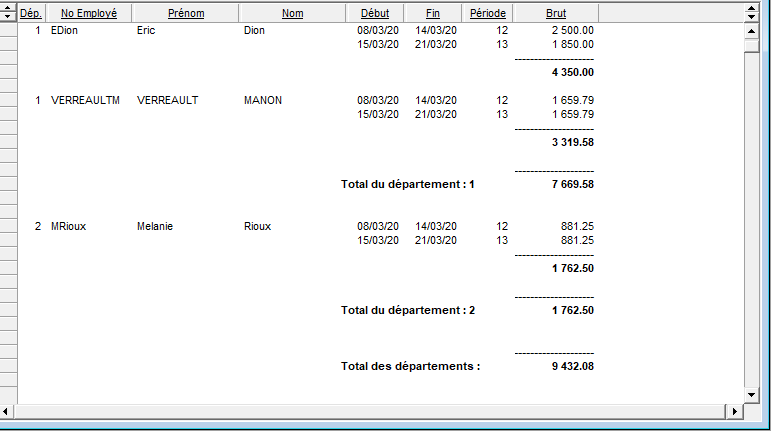

A specific payroll statement can be created for gross earnings in view of calculating the grant.

To create a specific payroll statement, proceed as follows:

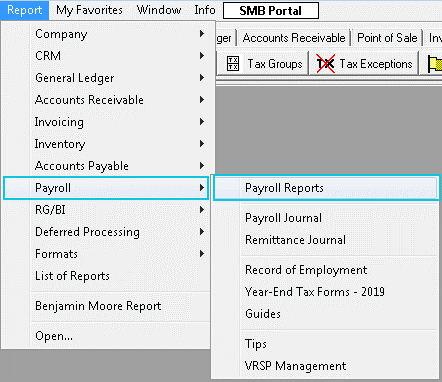

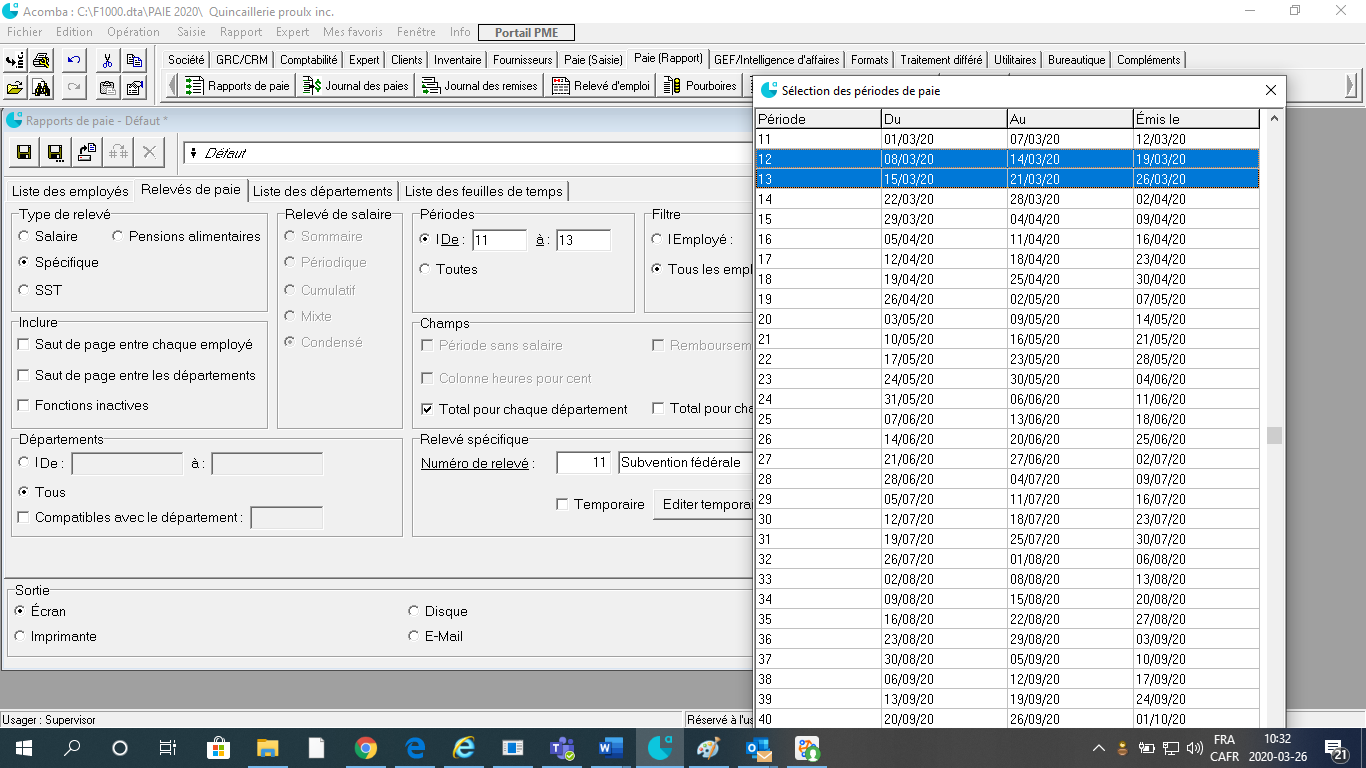

Click the Report menu and select Payroll > Payroll Reports.

The Payroll Reports window is displayed.

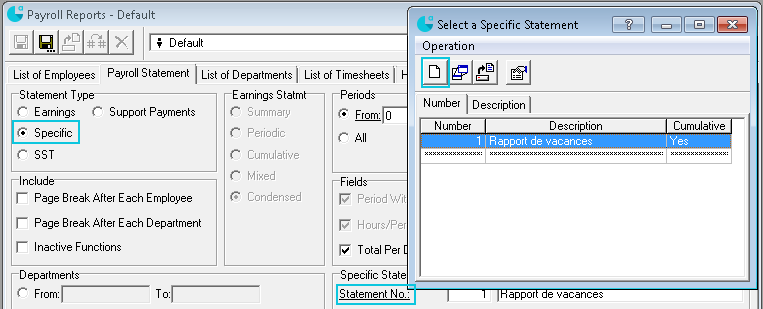

In the Statement Type group, select Specific.

In the Specific Statement group, click the Statement No. The specific statement selection window is displayed.

Click the  button.

button.

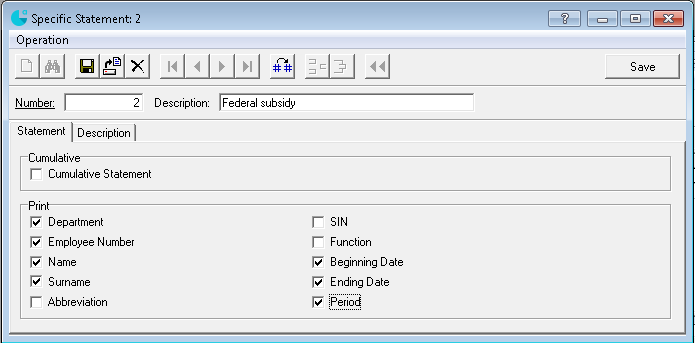

Enter a Number and a Description for the specific statement.

In the Print group, check the boxes corresponding to the employee information to include in the report.

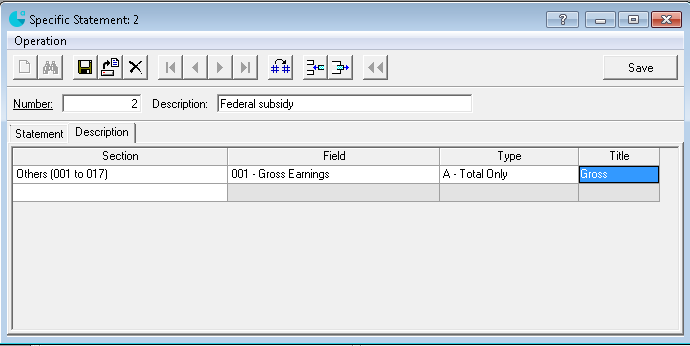

Click the Description tab.

In Section, select Others (001 to 017).

In Field, select 001-Gross Earnings.

In Type, select A-Total Only.

In Title, change the title to Gross.

Save the specific statement.

Select the payroll periods issued on or after March 18, 2020 until the end of the subsidy.

Produce the report.

Note: The gross earnings include the earnings lines under the Earnings tab, excluding line 109 Reimbursement of expenses. Verify the payroll lines in case there are other types of expenses.

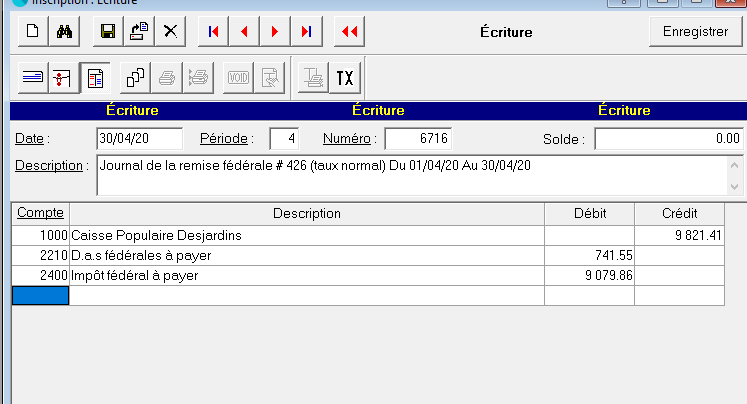

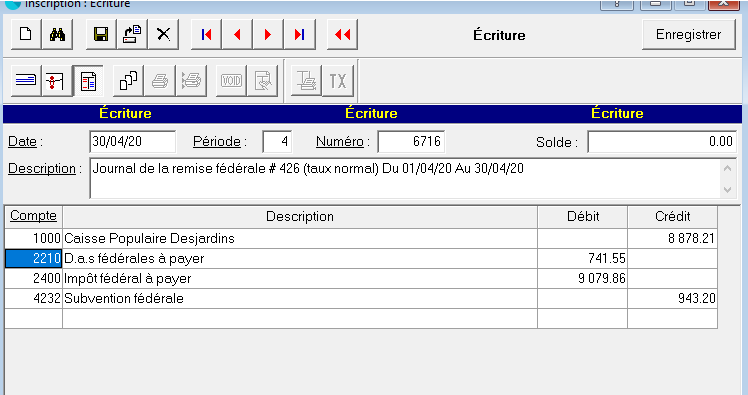

When entering the federal subsidy, enter a new income account (e.g. Revenue - Subsidy) in order to account for the 10% subsidy and reduce the payment.

Note: The maximum amount of the federal subsidy is $25,000 per employer.