Because the new rates were not available during the first week of July on the Commission de la construction du Québec’s Website, the payroll of some employees were issued using the old rates.

The procedure below explains how to correct the situation on the next pay period. Thus, the employees will receive the right amounts and will pay their union dues correctly.

In the example below, a journeyman has the trade code 110 with the wage appendix C3 and contributes to the CSN union.

Note: The rates below are only used for the purpose of the example.

The old hourly rate was $34.07 and the old union dues were $17.04.

The new rates are $34.75 for the hourly rate and $17.38 for the union dues.

The difference that should have been paid is $0.68 for the hourly rate and $0.34 for the union dues.

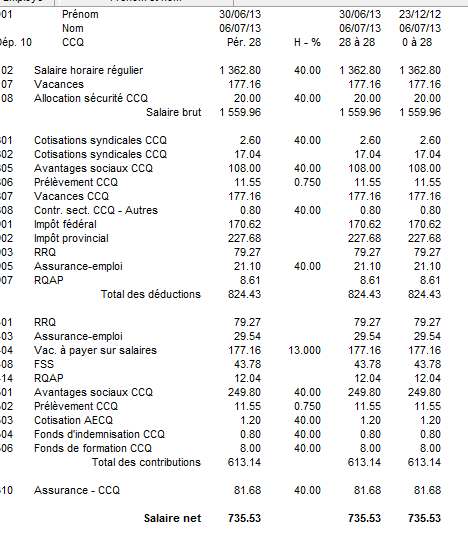

Here is the example of the employee’s payroll with the old rates:

The calculation should have been: 40 hours X $34.75 = $1 390. However, the employee received only $1 362.80. Therefore, he is missing $27.20.

Here is the procedure to make the correction in the next payroll:

- For the employee who worked 35 hours during the week, make the calculation as follows: 35 hours X $34.75 = $1 216.25 + the missing $27.20 of the incorrect payroll = $1 243.45.

- Bring the gross salary on 35 hours in order to get the hourly rate including the adjustment: $1 243.45 / 35 hours = $35.53 (for this week only).

- For the next payroll, modify the hourly rate directly in the payroll, not in the employee card.

- For the union dues, add the difference of $0.34 to the current week dues: $ 17.38 + $0.34 = $17.72 (for this payroll only).

For the next payroll, the hourly rate and the union dues of line 802 must be modified directly in the payroll, not in the employee card.

Thus, the contributory earnings of the CCQ remittance are automatically adjusted.

Note: In order to avoid the same issue again, the new rates must be entered in the employee cards.